Published on

7 May 2008

Tax and the Role of Government

By: Prof. Philip Booth— 2007-2008

ABOUT

Prof. Philip Booth is Editorial and Programme Director at the Institute of Economic Affairs Joint seminar with the ESCP–EAP, and held on their premises, on Wednesday 7 May 2008

At the Institute of Economic Affairs for a long time now we have tried to explore, as part of what we do, the moral underpinnings and the moral framework within which a market economy has to work. There is a feeling among those who work in the field of economics that the battle of ideas has been won in regard of the utilitarian benefits of a market economy – despite anything Gordon Brown may have done over the last ten years! There is an understanding that a market economy is more efficient than a centrally directed economy, that it leads to better economic growth, and so on. All that is now relatively well accepted.

Where the battle of ideas has not, however, been won is in trying to understand the moral and ethical benefits of a market economy and also the moral framework within which a market economy has to exist. One of the clear benefits of a free economy is that services are exchanged by agreements; not by central direction or by the votes of one interest group set against those of another, but by free contractual agreement. Economic resources are exchanged peacefully and a free economy as such, I would argue, provides, to a greater extent than alternative forms of economic organisation, a setting for a peaceful, harmonious society.

Where the battle of ideas has not, however, been won is in trying to understand the moral and ethical benefits of a market economy and also the moral framework within which a market economy has to exist. One of the clear benefits of a free economy is that services are exchanged by agreements; not by central direction or by the votes of one interest group set against those of another, but by free contractual agreement. Economic resources are exchanged peacefully and a free economy as such, I would argue, provides, to a greater extent than alternative forms of economic organisation, a setting for a peaceful, harmonious society.

As part of our programme, we decided a year or so ago, to publish a book Catholic Social Teaching and the Market Economy, which you can download from the IEA website (http://www.iea.org.uk/record.jsp?type=book&ID=410).

What follows this evening will not be one of those water-tight talks where I shall discuss issues under four or five headings and then come to some absolutely definitive and robust conclusion. This is partly because the nature of the subject is so wide but it is also in part because Catholic social teaching on economic issues does not lead to one or two definitive conclusions. Rather it provides a framework of analysis to help Catholics at least understand how they should think about issues relating to public policy and economics.

Introduction

Catholic social teaching is a body of thought that is laid out by the Church in order to give Catholics – though other Christians and non-Christians, too, have found it helpful – guidance in making judgements about the relationships between man, society and political institutions. The social teaching is found in many documents – perhaps most notably in the ‘social encyclicals’. The first of these social encyclicals of the modern era was Pope Leo XIII’s Rerum novarum published in 1891.

Catholic social teaching on economic matters – an aspect of which is the subject of my talk tonight – is not binding on Catholics. Principles are laid out and it is for specialists in the field – particularly the lay faithful – to apply the teaching to specific circumstances. Thus the Church might argue against confiscatory taxation and might simultaneously argue in favour of some redistribution to ensure that necessities can be purchased by all. However, it is for particular Catholics faced with particular situations to apply those ideas to practical policy-making in specific circumstances. In other words, there is wide scope for prudential, personal judgement in this matter – unlike, for example, in regard of the Church’s teaching on abortion.

Sometimes, Catholic social teaching has been more specific – as, for example, in the 1967 encyclical, Populorum progressio, which made some very particular recommendations for development aid government-to-government. Here again, the teaching is not binding and it has indeed become, particularly in later years, controversial as to whether or not development aid really aids development. The teaching can be provisional and it may be revised over time.

Main Themes

I want to talk about two or three applications but particularly on Catholic social teaching about taxation and the size of the State. I hope also to talk a little about the environment, and, if we have time, education. In developing the theme, I will talk about the ideas of subsidiarity and solidarity as well as about some ideas from modern economics. I will then look at particular areas of public policy where Catholic social teaching helps us make some judgements about how to proceed.

Christians frequently use the terms solidarity and subsidiarity to describe the extent to which free-market economic policy should be balanced by government intervention. There exist, it should be noted, distinct tendencies to consider these terms somehow competitive concepts: on the one hand, solidarity, a desire to have a more socialised economic system, and then balancing it, subsidiarity, the desire to allow decision-making to take place in the lowest levels of society. Discussions often coalesce broadly around centre-left and centre-right Christian-Democratic ways of solving social problems.

There is, nonetheless, often a serious misconception about the nature of solidarity. If one reads Vatican statements containing the word solidarity, perhaps only 10 per cent of the time is it used to indicate the pursuit of political ends by means of the political system – in other words government action to help the poor, the homeless, and so on. Even then, government action in the economic sphere is viewed by the Church as a last resort to be used only while the temporary circumstances that make it necessary continue to exist.

In fact, solidarity in its original political context first relates to how we view our neighbours. It is an attitude translated into good works through our actions as employers, within our families and in extended families, through professional associations, community groups, schools, parishes and so on. Finally, as a last resort, there is action through the political sphere.

Action through the political sphere has to be a last resort because it is necessarily coercive and thus circumscribes the freedom and creativity of those trying to address social problems and because government agencies cannot be as close to the problems that they are trying to solve as those who bind together in a voluntary capacity to help others. Pope Benedict XVI has made this very clear in his first encyclical, Deus Caritas est, which is, to a great degree, about charity. Taxation and redistribution by political authorities are not an extension of voluntary charitable activities – they are, rather, wholly different types of action.

In Deus Caritas est, Pope Benedict confirmed the message of John Paul II’s encyclical, Centesimus annus, about which I shall speak later, that a State that tried to provide for all material needs would become a mere bureaucracy. He also notes that charitable need is not just material, and that even in the most just State charity would be necessary, for it meets needs in a way that is more fully human than any a Welfare State can accomplish. The principle of solidarity demands government action to help the poor as a last resort – but, as we have seen, it means much more than that.

The principle of subsidiarity, too, demands that government and coercive measures be a last resort in the economic sphere. It is a complementary to, and not in competition with, solidarity. As the Rio Declaration on the Family put it: ‘Subsidiarity means that the family, not the State, not large organizations, must be given responsibility in managing and developing its own economy’.

We have seen the ‘principle of subsidiarity’ enshrined in the European Union. It has been said that Jacques Delors, head of the E.U. at the time the principle was enshrined in the treaties, was a Catholic who took this social teaching very seriously. In that context, it means that lower levels of government are responsible before higher levels of government for implementing E.U. policy. Whether or not this is put into practice is a moot point. It is, in any event, a quite different concept of subsidiarity from the one we see in Catholic social teaching.

In its proper context, subsidiarity means that there should be intervention in economic life only where it is deemed necessary; it also means that voluntary associations have responsibility to meet economic ends before any level of government is involved. But, crucially, subsidiarity is the process by which the State is used to help private and intermediate groups attain their legitimate ends, in the words of Catholic social teaching, never supplanting their initiative, but only facilitating it. In other words, it is not for government at whatever level to decide what the economic ends and the economic aims of society are and then to delegate the meeting of such objectives to the family and to individuals. It is rather for individuals and families do determine their own economic ends and, where these legitimate ends cannot be met through their own initiative, the State may put in place policies which aid them in doing so.

A good example of the application of this principle would be in education. The Church has often proposed a role for the State in financing education, indeed in some of its documentation it has described education as a human right but it has always declared that finance should be provided in such a way that parents’ wishes are never supplanted and that private education is not discriminated against. It is not, therefore, for the State to provide education and schools and to ensure that they are organised at the lowest possible political level. That is an E.U. interpretation of subsidiarity. It is, rather, for the State to help families, through providing finance or filling in gaps in areas of the country where there may not be schools, to fulfil their legitimate aspirations to educate their children as they themselves wish to educate them.

Interestingly, an area of economic thinking called ‘public choice economics’ makes explicit assumptions about human behaviour in understanding the imperfectability of man that should chime with Christians and these lead to conclusions that seem compatible with such an interpretation of subsidiarity and solidarity. Indeed, it is an irony, in fact, that much modern economics actually incorporates a more Christian understanding of human nature than do many Christian pronouncements on matters of political economy.

Public choice examines the results of applying the assumption of the imperfectability of man in political life. This manifests itself in two main ways.

First of all, we cannot assume that politicians, bureaucrats and voters necessarily behave in the public interest, or for the common good, when they take action – they may, in fact, behave in their own interest.

Secondly, politicians and bureaucrats have imperfect knowledge so that, even if they wish to pursue the public interest, they can neither work out what the public interest is nor develop policies that can be reliably assumed to pursue it. This is a mere summary of a deep, rich and complex school of thought which has won Nobel Prizes.

There are a number of implications of public choice economics, but the most important is this. We should understand that when there are imperfect outcomes of market processes (poverty, under-provision of education, environmental problems – particularly relevant as they are to the global warming debate –, monopolies, etc.) such problems cannot necessarily be corrected through, and may be made worse as a result of intervention by, government. We cannot blithely assume that government can perfect imperfect societies. Ultimately we must recognise the reality of the imperfectability of man acting within the political sphere.

There is more to be said about this subject, but I will move on while asking you simply to ask yourselves whether when Christians make statements about government intervention in economic life to help the poor, the ‘Third World’, and so on, they may be implicitly assuming that government agents have omniscient knowledge and a flawless nature. Let us look, then, at what Catholic teaching has had to say about taxation and the size of the State – my main theme tonight.

Catholic Teaching

Catholic teaching in this area is at once clear and leaving plenty of room for debate. I am going to begin this section by presenting some often-ignored statements against taxation and too much government intervention in the economic sphere. I shall then go on to discuss the ‘current state of play’, if you like, in U.K. and other E.U. countries regarding the size of the State and its compatibility with some of these statements.

The following passage, from Rerum novarum, published by Pope Leo XIII in 1891 is pretty clear:

Socialists, therefore, by endeavouring to transfer the possessions of individuals to the community at large, strike at the interests of every wage earner, since they would deprive him of the liberty of disposing of his wages.

Two qualifications should be borne in mind when considering that statement. First, when the Pope wrote here of ‘socialists’, he was not referring to the likes of Gordon Brown or Tony Blair. He was thinking rather about socialists of the Marxist type and was responding to the growth of Marxism.

Second, it is for us to apply these ideas to the situations in which we find ourselves. One of these, as we shall see later, is the state of affairs wherein the governments of most E.U. countries spend around 50 per cent of total national income. Although socialists may not be transferring all the possessions of individuals to the community at large, it is nonetheless clear that those individuals do not control the spending of a very large proportion of their income. It is clear that when Leo XIII was writing the proportion of national income taken by the State in most European countries will probably have been in the order of about 5 to 7 per cent in peacetime and 10 to 15 per cent in wartime.

Paragraph 13 of the encyclical stresses the complete primacy of the family over the state. Rerum novarum sees no place for the pursuit of equality as an end in itself, nor for taxation for its own sake. This would appear to preclude systems of taxation that lead to greater equality but make everyone, including the poor, poorer. Rerum novarum states:

The door would be thrown open to envy, to mutual invective, and to discord; the sources of wealth themselves would run dry, for no one would have any interest in exerting his talents or industry; and that ideal equality about which they [socialists] entertain pleasant dreams would be in reality the levelling down of all to a like condition of misery and degradation (paragraph 15)

It then goes on to state that inequality is far from disadvantageous to individuals or to the community. The Church has become more concerned in recent decades about wealth and income inequalities but it has never regarded them as intrinsically a bad thing.

Pope Leo expresses belief in the supreme importance of private property – something from which the Church has stepped back slightly since the encyclical. He praises the principle of charity by which people should give to others that which they do not need for themselves. It is suggested that giving alms is a duty of Christian charity – ‘a duty not enforced by human law’ (as redistribution through taxation is). Rerum novarum, in fact, makes the case very strongly that Christian charity is the prime mechanism for helping the poor.

Nevertheless, it is clear that providing citizens with a basic income (for food, clothing and shelter) is a potential role for taxation envisaged by Pope Leo. Actually he places emphasis on companies providing employees with a ‘living wage’ rather than on creating a system of redistribution through taxation. The relative merit of these two forms of assisting the poor can certainly be disputed by economists. But he particularly cautioned against taxation of the poor and believed property ownership was vital for the poor.

Forty years later in Quadragesimo anno (1931) Pope Pius XI did not envisage a significant role for taxation in redistribution either. Strong statements were made against taxation of the poor and the pursuit of equality for its own sake. For example,

Wherefore the wise Pontiff [Pope Leo] declared that it is grossly unjust for a State to exhaust private wealth through the weight of imposts and taxes. (paragaph 49)

Strong statements are also made about the lack of resources of the poor, but charity is regarded as the chief mechanism by which people should do good with their spare income:

the rich are bound by a very grave precept to practise almsgiving, beneficence, and munificence. (paragraph 50)

Pope Pius does suggest that a wage sufficient for basic family needs (adjusted according to family circumstances) should be assured (paragraph 71). Whilst the taxation system and the State are not mentioned explicitly for this purpose one assumes that the State should at least be the last resort in providing for basic needs if they are indeed to be assured.

Pope John Paul II’s encyclical, Centesimus annus, published in 1991, echoes in many respects faithfully the sentiments of Rerum novarum. There are to be found in it many warnings about the power and size of the State. The Pope continues to support redistribution to provide for basic needs, although, once again, the main responsibility for ensuring adequate incomes is placed on private-sector bodies – employers and unions. Centesimus annus contains a general comment on the Welfare State which speaks for itself – but one has to bear in mid that these encyclicals are often translated from Latin into English so the interpretation may not be as black and white as it seems:

In recent years the range of such [government] intervention has vastly expanded, to the point of creating a new type of State, the so-called ‘Welfare State’. This has happened in some countries in order to respond better to many needs and demands, by remedying forms of poverty and deprivation unworthy of the human person. However, excesses and abuses, especially in recent years, have provoked very harsh criticisms of the Welfare State, dubbed the ‘Socia lAssistance State’. Malfunctions and defects in the Social Assistance State are the result of an inadequate understanding of the tasks proper to the State…

Note that ‘society’ is not used as a synonym for ‘State’ or ‘government’ – rather, quite the opposite. In Catholic social teaching, there is a very strong emphasis on, and consciousness of, the State as something quite distinct from civil society and not merely an extension of it.

This encyclical continued not just to be critical of certain outcomes of capitalist economic systems – problems such as those of consumerism, materialism and drug abuse which may perhaps be discussed in later seminars – but it also emphasised the role, as a guarantor, of systems of social insurance: in other words, private or voluntary collective arrangements of providing for need in times of unemployment. It also laid out very clearly the importance of having a sound legal and monetary framework and efficient services for a proper market economy to exist. The activity of the market economy cannot be conducted in an institutional, political or juridical vacuum. On the contrary, it presupposes sure guarantees of individual freedom and private property as well as a stable currency and efficient public services.

It then goes on to lay out what the principal task of the State is: not redistribution, not a big role in economic life, but rather provision of this framework within which individuals will find themselves better enjoying the fruits of their own labours.

These statements from Catholic social teaching have been chosen collectively to illustrate particular points. Certainly as I have already mentioned, Catholic social teaching has plenty of criticisms for the outcome of a market economy and sees legitimate room for debate about how those defects should be addressed.

I think these statements, together with other teachings, make it pretty clear that the State’s role in economic life should not be intrusive and that it should act as a last resort. The principle of subsidiarity demands that help be given to enable individuals and families meet their legitimate needs. Thus the family’s economic behaviour should not be over-regulated and members of the family should not have so large a proportion of their income taken away in tax as to prevent them pursuing their own goals.

Taxation, Inefficiency and the Work Effort

The micro-economics of taxation suggests that tax leads to inefficiencies and disincentives to work. This seems to have been anticipated by the popes in their encyclicals.

When looking at the tax burden in practice, we need to distinguish between two concepts: the marginal rate of tax and the average tax burden. A high marginal rate of tax is most likely to impair industry and effort in the group to which it applies, as suggested by Pope Leo above. For every pound an individual earns today, a high percentage is taken away in taxation. The average rate of tax shows the extent to which the government is financing activities that might be financed by subsidiary entities – including families.

Average tax burdens today are very high throughout the developed world by historical standards, reflecting to a large degree the development of what Pope John Paul II styled ‘social assistance States’ throughout the Western world. It is very difficult to see how such tax levels can be justified by applying the concept of subsidiarity and an authentic interpretation of the principle of solidarity. The State is spending as much as the family. It is intervening very heavily in economic life. We should remember that, when the popes issued their early encyclicals warning about high taxation, tax levels would have been about 10 per cent of national income.

In the table below you will see levels of government spending as a proportion of national income vary between countries. They range from 60 per cent in Sweden to 35 per cent percent in Ireland. The UK is somewhere in the middle with 42.8 per cent. The U.K. tax burden is, however, rising rapidly. It will be, I believe, something like 47 per cent next year, and then higher the year after.

| Country | Government Spending as a Proportion of G.D.P. |

| Sweden |

59.0% |

| France |

54.4% |

| Belgium |

49.7% |

| Germany |

49.4% |

| Italy |

48.5% |

| The Netherlands |

48.5% |

| U.K. |

42.8% |

| Japan |

38.3% |

| U.S.A. |

35.9% |

| Ireland |

35.2% |

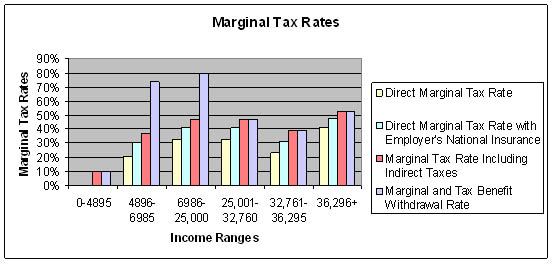

The marginal tax rate represents the number of pence that are paid to the government from each extra pound of gross income earned. Some attempt to illustrate the very complex picture for the U.K. is given here below.

The level of explicit taxes on income, the most frequently quoted marginal tax rate, is the smallest bar for each income group (zero at very low levels of income): this rate includes employees’ National Insurance contributions and income tax. However, this does not illustrate the full impact of tax. National Insurance contributions are also paid by employers and their inclusion leads to marginal tax rates of between 30% and 45% for all income groups, except the very lowest. Also frequently ignored is the impact of indirect taxes levied on spending from retained income. This takes marginal rates up to about 40% for all income groups, except the very lowest. This estimate would seem reasonable, given the overall fiscal burden of 44.9% quoted above and demonstrates the difficulty of achieving variation of tax rates with income once the overall tax burden has reached a high level.

In the U.K. ‘child tax credits’ are paid to families with children. These are, in effect, means-tested social security benefits. They are withdrawn as the income of a family rises. For a recipient of tax credits, the marginal tax and tax-credit withdrawal rates combined are 80 per cent between the lowest levels of income and average income (approximately £25,000). Whilst tax credits are not taxes as such, and therefore not part of the tax burden, it is the rate of withdrawal of the credits combined with the rates of tax that determines the impact of decisions about whether to work, and how much to work.

The tax system in the U.K. impacts on families in a particularly unfortunate way. Two examples are worth noting. If we take a family earning £25,000 with one earner and two children (for example, with the mother working in the home) the family would gain over £2,000 per annum of net income by having both family members going out to work with each earning £12,500. This arises because child tax credit is awarded on the basis of family income but income tax and national insurance allowances are personalised. If the same couple split up and lived separately, the tax bill would be unaffected, but benefits would rise dramatically (by several thousand pounds). These illustrations are not dramatic examples of quirks, but rather an integral part of the UK tax and benefits system.

These disincentives to self-sustaining family units and child-rearing within the home do not seem compatible with Catholic social teaching on tax and welfare matters. This is particularly so because one of the side effects of this situation is the sheer number of dual-earning, low–income, families whose children the State takes responsibility for looking after. It is possible to design tax and benefits systems that do not give incentives for income-splitting and household disintegration.

So, although high levels of tax are often justified on the ground of assisting the poor – ‘the preferential option for the poor’, if you like – Pope Leo was right. The poor can experience the most deleterious effects of high taxes. Redistribution cannot be effective unless the overall tax burden is reasonably low. The poor in the U.K. pay both high average and high marginal rates of tax. The poor are also less able to re-arrange their affairs in ways that avoid high rates of tax, and they are often caught in the most complex aspects of tax systems.

Conclusions: Taxation and the Role of the State

So, to conclude, the Church takes the idea of property rights very seriously and taxation is an infringement of property rights. Taxation for redistribution to provide ‘basic needs’ is legitimate but only if other methods of providing for these needs fail. Charity is regarded as a better way of assisting the poor than corrosive taxation. It is also clear that there is disapproval of the State taking upon itself the role of an agent of welfare through modern forms of Welfare State. In my view, it is not possible to reconcile current level of taxation in the developed world with these teachings.

However, one should never be specific about the proportion of G.D.P. that involvement by government in areas of economic life proposed by Catholic social teaching might entail. It is perfectly reasonable for somebody to argue that these levels of government spending of national income are justified in the context of Catholic social teaching, which only sets out some principles. Secondly, the teaching is not binding in the same way as it is in non-opinable theological and moral areas.

However, one aim might be to reduce the role of the U.K. State to that of financier of the last resort for welfare and education provision. I lay stress on choosing the term ‘financier’ and not ‘provider’. This is very important for helping the poor purchase health and education, as happens on the Continent, to a considerable degree in countries like Holland and Sweden. These States do not provide education, but rather provide finance to help people attain an education. This can be combined with some income redistribution to help the poor purchase basic goods. Such practices would probably reduce government spending in the U.K. to less than half of what it is currently.

Taxation also directly impacts on choice in many ways, some of which undermine human dignity and certainly reduce welfare. Pope John Paul II made clear in his encyclicals that when man’s freedom in the economic sphere is curtailed his dignity as a human person more generally is curtailed. He made the point that socialism went against the anthropological nature of the human person as a free individual able to make choices. When those choices are curtailed, there is a sense in which the person becomes less fully human.

But this all leaves much room for prudential judgement. The extent of redistribution, precisely for whom the State should finance education and precisely how it should facilitate provision of insurances such as those for health, disability, unemployment and so on, are matters for personal prudential judgement after analysis of theory and evidence.

My own view is that the market economy, more than interventionist State provision, provides the ‘preferential option for the poor’ more effectively and that it is as well an authentic expression of subsidiarity. Charity and voluntary action are authentic expressions of solidarity. However, there is a role for the State and for taxation with a view to redistribution.

More generally, the Church is aware of the limitations of political structures, something that is studied in detail in public choice economics. Certainly, the idea that political structures, so long as they are democratically elected, should have no restraints on their power in the economic realm is explicitly rejected. Political structures are not an extension of voluntary society as many socialists like to think they are.

As the recent Compendium of the Social Doctrine of the Church states:

Experience shows that the denial of subsidiarity, or its limitation in the name of an alleged democratization or equality of all members of society, limits and sometimes even destroys the spirit of freedom and initiative.

On the issues discussed in this chapter there is much scope for prudential judgement. However, in order to promote discussion, I will end with a debatable assertion that Catholic social teaching, informed by economic theory, provides little succour for those who believe that taxes should be raised further from their current level of between 40% and 60% of income in most of the E.U.